Every commercial importer to Canada must pay all applicable duties and taxes to Canadian customs — but how do you know what you need to pay?

For example, you own a garment factory, and you want to start importing clothing into Canada. You will need to pay duties and taxes on those items. How do you classify your items to ensure you are paying the correct duties and taxes? Are your items part of a free trade agreement? Stepping back a little, how do you determine the country of manufacture of your item to see if it’s even eligible under a free trade agreement?

There are two ways an importer can determine their Canadian customs fees:

- Self-declare the item to the Canada Border Services Agency (CBSA), or,

- Hire the services of a Canadian customs broker who does it all for you

Self-declaring your items has the benefit of saving money on hiring a customs broker. The downside is your left trying to navigate the ever-changing and complex regulatory environment that is Canadian customs. More importantly, you might receive hefty fines if you make an error, even if it’s an honest mistake.

What is a Canadian customs broker?

The customs broker receives a copy of the commercial invoice for the goods you are looking to import into Canada. They will then classify your goods which will determine how much it will cost to import them through Canadian customs.

They can also help you ascertain which country will be indicated as the country of manufacture for the goods you are looking to import.

In a world with global supply chains and free trade agreements, figuring out the country of manufacture of your item can be a challenging task — with important implications for the taxes and duties you will need to pay.

How do you know which duties and taxes apply to your imported goods?

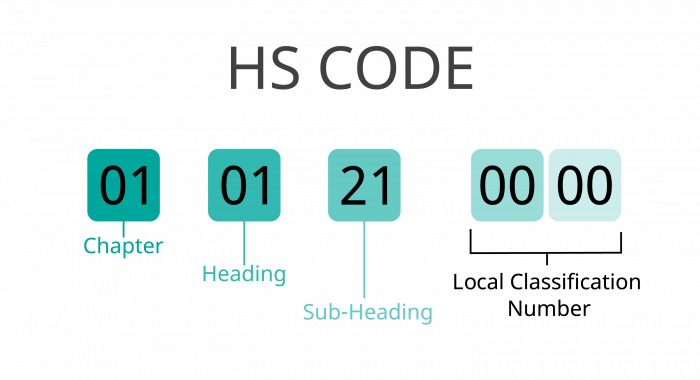

The World Customs Organization (WCO) classifies all goods imported into Canada and assigns a unique HS code to the item. The HS code, or Harmonized Item Description and Coding System, is usually a 10-digit code that determines the rate of duties and taxes that are assigned to your imported item.

The item description on your shipment should be descriptive enough for Canadian customs to verify your HS code.

For example, if your item description is simply shirt, there are many different codes that could apply. What materials make up the shirt? Is the shirt for children or adults? All these things factor in when deciding the appropriate HS code for your imported item.

What happens if you incorrectly assign the HS code?

Indicating the wrong HS code, by accident or on purpose to pay less duties and taxes, can result in audits. If you are found to be importing goods with an HS code that doesn’t fit your item, this can result in substantial fees that accrue interest. In the event you do not pay the fees, the government can seize your assets and sell them to service your debt.

Indicating the wrong HS code is more of an issue for those who self-declare their imported goods. This is largely because of the complexity of the HS code system which can change over time. However, regardless of whether you use a customs broker or not, you are ultimately responsible for the goods you import.

In other words, the customs broker is not liable, unless you can prove negligence. Therefore, you should carefully select your broker because at the end of the day, you’re on the hook for the information you declare to CBSA.

How do you keep up with all the changing regulations?

Changes occur all the time. For example, currently if you don’t have a customs bond, the broker is the party guaranteeing that the taxes and duties will be paid to the CBSA — but things are changing. The CBSA Assessment and Revenue Management project, or CARM, will mean that the payment of duties and taxes will be the exclusive responsibility of the importer and not the customs broker.

Phase I of CARM went live in May 2021. The focus of phase I was to get everyone who imports goods into Canada to sign up to the platform. Phase II begins in May 2022, which will make using the CARM platform mandatory. All importers will need to have an account and manage their payments through the CARM platform.

The best way to keep up with changes to Canadian customs regulations is to work with a certified Canadian customs broker you trust but you can also keep track of any changes by frequently reviewing the Government of Canada’s website.

The one thing everyone gets wrong about customs brokerage

Assigning the wrong HS codes is the number one mistake importers make. Five or six HS codes might apply, but in the end, there is only one that fits the description of your item.

If your audited and found to be using the wrong HS code and paying less duties and taxes than you should be, they can request the difference in payment for all shipments you’ve made previously. Conversely, if you were paying more duties and taxes than you should have, you will be refunded this amount.

The skilled professionals at ENERGY Transportation Group are cross-border shipping specialists. We move thousands of loads across North American borders every year and we also offer customs brokerage services. Get a free quote today!