Last week, the CBSA (Canadian Border Service Agency) noted that truck crossings between Canada and the USA were down 24% year over year (23-29 March). In a statement CBSA said, “Essential travel continues unimpeded. It is absolutely necessary to keep the economy moving at this time without disruption in order to bring essential goods to market and maintain integrated supply chains. These supply chains ensure that food, fuel, and life-saving medicines reach people on both sides of the border.”

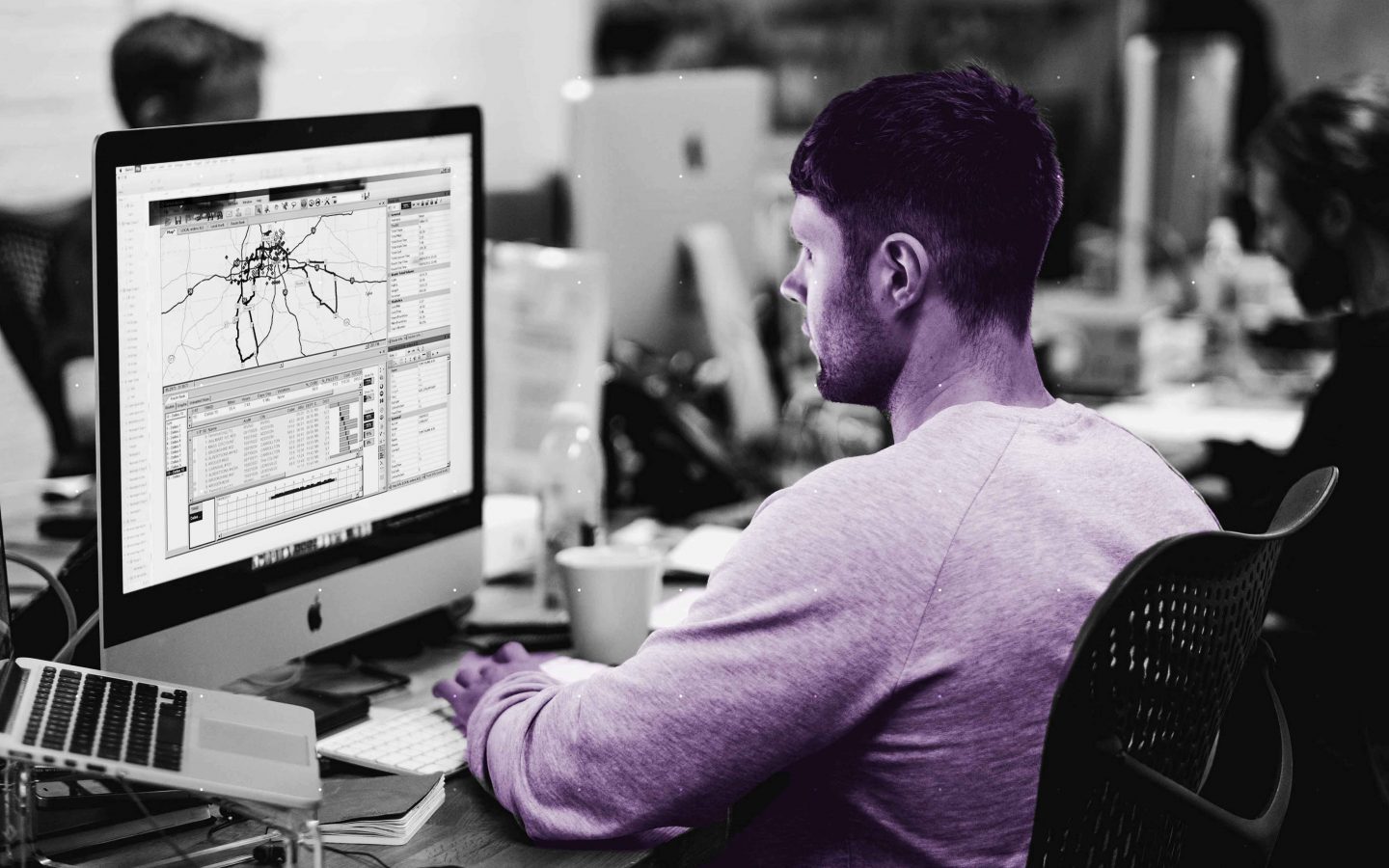

As North America progresses in the battle against the spread of COVID-19, many provincial and state authorities have updated their list of businesses deemed essential to continue operations. “Right now, there are no restrictions by CBSA with respect to commercial shipments, or rendering certain products as nonessential,” noted David Grassi, Vice President of Operations at ENERGY Transportation Group. “What we are seeing though, are businesses who have been classified as nonessential, or businesses who have made a decision to close for the protection of their employees, shuttering their operations. This has reduced the number of available truckloads across North America.”

In Canada, there are several provinces considered high consumption/low production. In truckload terms, the metropolitan areas of these provinces are considered “inbound towns”, and as a result, an imbalance of trucks and equipment exists. “This is causing us to experience an increase in deadhead miles,” Michael Cinquino, ENERGY’s president and co-founder relayed to the company’s leadership in a conference call this week. “Without the normal pick-up and delivery density, we’re having to run our drivers further between loads. This significantly increases our cost to operate.”

Even though volumes in the cross border are down, demand seems to still be outweighing capacity. “While we have some customers that are taking a hiatus from shipping and receiving, the capacity issue seems to be more on the carrier side,” Grassi commented. “While we have 100% of our drivers working, many of our subcontractors who haul for ENERGY in the cross border have either furloughed their drivers or repositioned large percentage of them to domestic Canada lanes because of the driver’s fear relative to the risk of contracting the virus thousands of miles from home and/or in another country (i.e. the USA).”

In conversations we’ve had with ENERGY customers, the general consensus is that they have already accepted rate increases, or are preparing themselves to accept an increase in cost for the cross border shipments. The lack of available truckload capacity, both north and southbound across the border, exacerbated by the additional cost of deadhead miles, is severely impacting the cost per loaded mile in cross border trade.

To stay aware of how the current crisis may impact your supply chain, contact an ENERGY team member through our contact form.