One of my longtime mentors in the logistics business would often say, “pigs get fed, and hogs get slaughtered”. I understood immediately that what he meant by this is, being too greedy, or too ambitious could cause your ruin.

In our business, whether the market is tightening because of supply/demand or there is added complexity, we should continue to act with integrity, and only charge what is reasonable. To gouge clients in times when they rely on us the most, could end the relationship altogether.

Market in 2018

In 2018, the truckload market in the United States and Canada was extremely volatile as demand increased, capacity tightened which then caused retail prices to increase. This caused many of our clients in North America, some who are public companies, to report decreased earnings to accommodate higher costs of transportation, whether they were inbound raw materials or outbound distribution of finished goods.

2019 Looks Promising

So far this year, shipment volumes remain strong, although down about 3% from the last quarter, we are seeing the market return to normal. However, because we are used to operating in a volatile environment that was caused by a US GDP quarterly growth rate of more than 4% in the 2nd quarter of last year, it feels like a freight recession. We expect the quarterly US GDP growth to average between 1.8% – 2.3% in 2019, which is still considered healthy growth for freight markets.

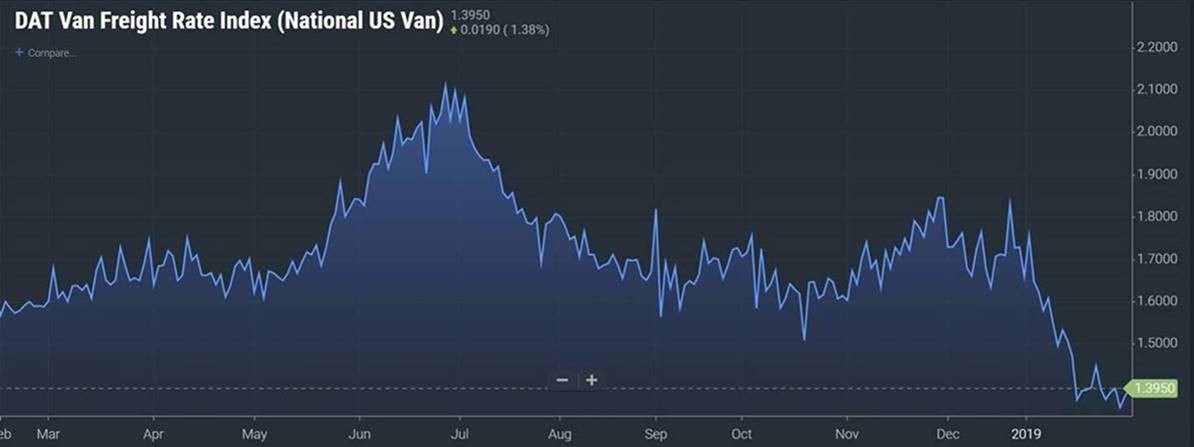

We are seeing an increased capacity situation, up about 2% from last year. This is a result of additional investment by asset-based carriers in new equipment, an aggressive driver recruitment strategy, and better asset utilization (specifically resulting from better Hours of Service management). As a result, capacity has loosened significantly, and per mile pricing is at the lowest we’ve seen it (as is illustrated in the below DAT Dry Van Rate Index compiled by FreightWaves).

As a shipper, if you were sitting across the table from carriers, freight brokers, and 3PLs last year taking unprecedented rate increases – rest assured – the market has normalized, and in 2019, you will recognize pricing that more resembles what you are accustomed to. Even though operating costs for truckload carriers (especially in driver pay and cost of insurance) have increased, the cost of fuel is still relatively low, which should result in only a moderate cost increase (2-3%).